Budget 2018 in brief: what were Philip Hammond's key points?

Fiscal Phil is well on his way in the journey towards the Brexit deal next March but what has he promised in his Budget in the meantime?

Fiscal Phil is well on his way in the journey towards the Brexit deal next March but what has he promised in his Budget in the meantime?

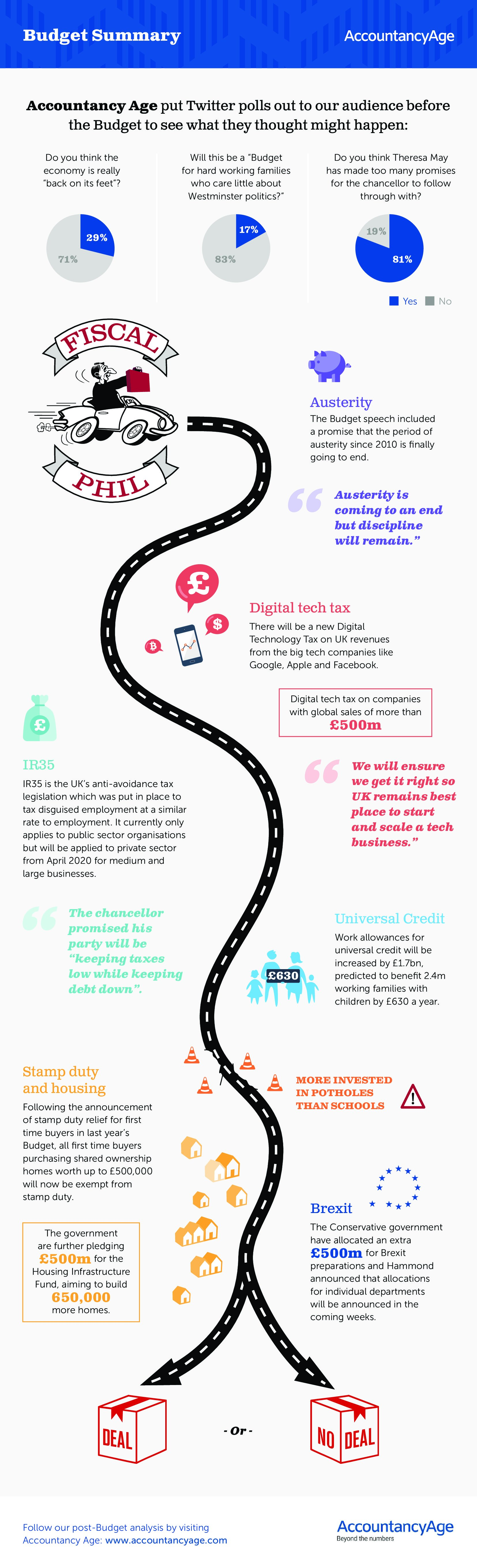

On 29 October 2018, chancellor of the UK government, Philip Hammond, delivered his Budget speech to the nation in the House of Commons.

He touched on a wide range of points and made a great deal of promises, speaking on topics including austerity, defence, housing, the NHS, Brexit, and digital tax.

Hammond announced many changes that are likely to directly impact accountants, including the move to extend public sector IR35 reforms to the private sector.

He also promised business rates for all retailers in England with a rateable value of £51,000 or less would be cut by a third.

The chancellor did not leave out his promise for a UK-wide digital tech tax on large, global technology companies such as Google and Facebook. The EU are yet to agree on a worldwide one.

Perhaps the most joked about aspect of the Budget 2018 was the announcement that more money would be spent on roads than on education, an aspect that received quite a lot of backlash.

While Hammond extended the budget for Brexit, it made sure to stay light on plans for Britain’s exit from the EU. This paved the way for Hammond to announce a Spending Review next spring, which has potential to be another full-blown Budget if needed.

More about:

The numbers you crunch tell a story. Your expertis...

6yEmbracing user-friendly AP systems can turn the tide, streamlining workflows, enhancing compliance, and opening doors to early payment discounts. Read...

View articleOrganisations can enhance their financial operations' efficiency, accuracy, and responsiveness by adopting platforms that offer them self-service cust...

View articleIn a world of instant results and automated workloads, the potential for AP to drive insights and transform results is enormous. But, if you’re still ...

View resourceDiscover how AP dashboards can transform your business by enhancing efficiency and accuracy in tracking key metrics, as revealed by the latest insight...

View articleAs the UK awaits Chancellor Rachel Reeve’s Autumn Budget on October 30th, 2024, accounting firms are forecasting sweeping changes to the tax lan...

View articleThe cumulative corporation tax earnings from April to September reached £43.3 billion Read More...

View articleChancellor Jeremy Hunt has unveiled the contents of his first Budget in the House of Commons Read More...

View articleThough likely to be lacking in headline-grabbing policies, the 2023 Spring Budget could prove critical for the UK economy Read More...

View articleAs the Spring Budget approaches, dissenters of the UK government’s increasingly complex contractor legislation are baying for change. HMRC has already...

View articleHMRC service levels have fallen to an “unacceptably low level” and must be urgently addressed as part of the forthcoming Spring Budget statement, the ...

View articleClarity is desperately needed following a series of U-turns, market participants have said Read More...

View articleThe Office for Budget Responsibility judged that the UK is already in recession, with the economy set to shrink by 1.4% next year Read More...

View article