Technology is disrupting the accountancy sector. However, practices should be embracing this change and recognising it as an opportunity. Accountants no longer need to be sat at a desk filing reports and entering data into spreadsheets. New technological advancements within the industry are enabling them to focus on more advisory work, from anywhere and with any device. Being efficient and flexible are becoming essential requirements for all businesses, yet practices have generally found it a challenge adapting to more modern ways of working.

It can be difficult to keep up with what is happening in different departments; each department in a practice has different priorities and targets to hit, headed up by one partner essentially like a standalone business. Technology can bridge gaps, ensuring the business operates according to the underlying strategy, inclusive of all departments. This leads to improved customer experience, better-integrated teams and more opportunity to make each client more profitable to the practice.

Here are some tools that will help innovate your practice processes and in turn contribute to business growth in the future.

The breakthrough of Practice Automation

Wouldn’t it be nice to lift those prevailing administrative burdens? Those mundane, zero value tasks that need to be completed to deliver the real work. Practice Automation is the hot topic that most accountants are talking about, but few have tested the waters.

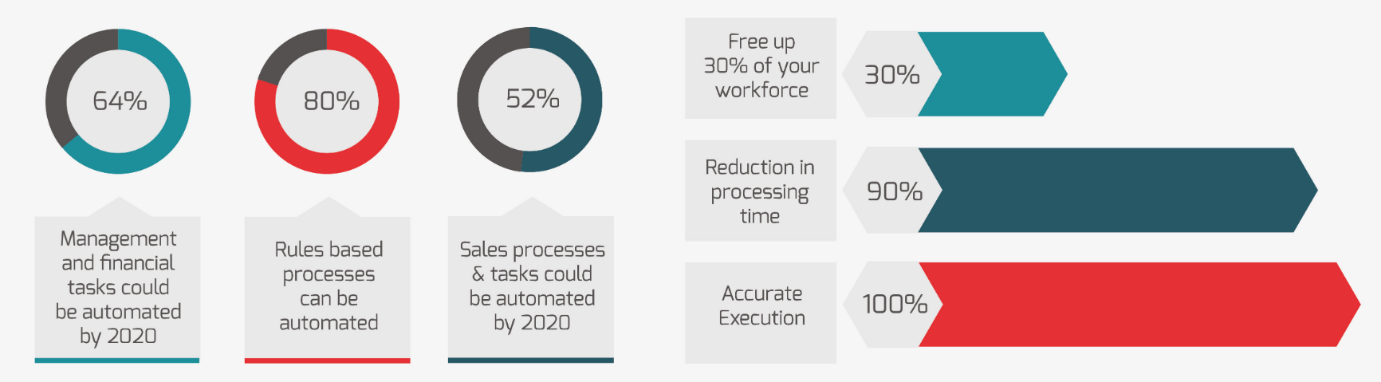

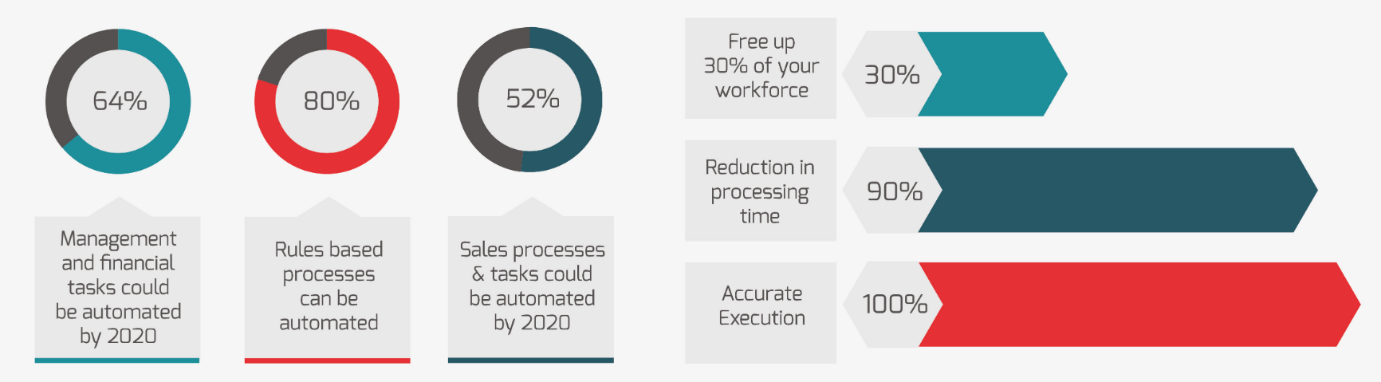

Accountants do a lot of repetitive work, such as copying information from one application to another, which takes up a lot of time and resources. They have many repetitive processes, so it should be easy to map out a set of rules; tasks such as KYC or Personal Tax are great examples. Thesecan be automated. Our partner Thoughtonomy found that 80% of rule-based processes can be automated, meaning that 30% of people’s working hours could be freed up. Practice Automation adds a new layer to Robotic Process Automation (RPA), as it can mimic human interaction with its advanced intelligence. So many elements to your firm can run by a virtual process, whether that be a client portal, KYC, payroll, or preparing a personal tax submission.

The impact on organisations

Tasks that would take a whole team of people over a month can be automated to be completed in a day – a single virtual worker can take on the work of between 3-15 human workers, it can go as fast as your other systems will allow it to, and it doesn’t take breaks or holidays. But this is not about putting your people out of work. This technology is designed to transform your business, so that eventually your people can focus solely on the human element of their work, such as building relationships with their clients, delivering the real value in advisory, and taking over when the automation has done its job. Your practice could be improving customer satisfaction levels by 50%.

The impact on customers

Automation is made for a sector like accountancy: repetitive, detail focused, with many points of data entry required into multiple platforms, where sought-after resources are not getting to spend their time delivering customer satisfaction. Intelligent automation is the answer.

Get smart with Practice Intelligence

Business reporting tools are a major player in enabling a practice to be at the top of its game. Many practices rely on native reporting systems to track their progress. Often having to wait for the monthly partner’s meeting to gain an overview of the firm. The problem with these reporting systems is that they are often static in content, meaning a lot of manual labour is required to run the reports, manipulate them into meaningful data and then present them in a reader-friendly format. Data is constantly changing, and reporting on the data should be instant, robust and feeding from all the practices’ systems.

Practice Intelligence delivers just this: an intelligent way for all managers and partners to see live up-to-date information on clients and staff members, allowing access to what is needed instantly. It is user-friendly and allows for customisable dashboards, showing only the relevant information, live.

As a manager of a department, it can be difficult to know exactly how each of your team members is performing daily. This technology allows for each partner/manager to see a visual overview of their (and all) departments, as well as being able to monitor individual’s growth. Having these easily accessible insights allows each department to focus on what is important to them, spot gaps, and react to challenges quicker and more effectively.

Tying it all together with Microsoft Teams

Adopting automation and these modern modes of working is the way forward for firms, and we are lucky to have all these different technologies. But they are often not easy to use because they all run differently. We know ourselves from experience, that multiple solutions running separately from each other is frustrating.

Email burnout is a topic being discussed more and more, thus solutions need to be sought out to ensure people can communicate and collaborate on work effectively, without adding more numbers to the inbox icon.

Ideally it would be great to have a hub that connects – a central place for communication and collaboration across the board so everybody is always in the loop, but they can consume this data at the right time without clogging up inboxes. You may think, we have an intranet and chat functions so this is covered, but this is addressing much more. This hub is about not only having a place to share ideas, news and information to the business. It’s a secure solution for working anywhere, on multiple devices, reducing the amount of emails people send, collaborating effectively, and conducting virtual meetings or calls without having to send around separate log in details. It also protects the firm and its client data by ensuring information is only on corporate applications.

This is the job of Microsoft Teams: it brings all team members to one, single, chat-based platform, giving each department the opportunity to collaborate with peers on documents, video conferencing, or simply a one to one chat. A Forrester study found employees could be saving four hours a week through the improved collaboration and information sharing Microsoft Teams provides.

Microsoft Teams is revolutionising the way businesses are running, allowing for flexible and agile working. Meetings are made easy with a fully integrated phone and video conferencing system, retiring from the necessity of traditional desk phones, or online calling applications. The same study by Forrester estimates up to 18.9% of meetings can be reduced each week. Most probably don’t even realise how much they are spending on all the individual systems and applications, such as phone systems and video conferencing, which is why Microsoft Teams is a cost-effective business decision.

Next year, BT will be turning off their ISDN and PSTN phone networks so any company on this old phone system will need to be looking into their options. This is a great time to review overall how the firm communicates and the tools they use. Phone systems can be an expensive cost to a business and bringing this all into Microsoft teams is a cost-effective modern way of working.

Make the leap

To stay afloat in the rapidly evolving world of technology, having the right tools in place will help to adapt to the changes. Intelligent Automation and modern collaboration tools are allowing businesses to function in a way they have never worked before. But it’s not just about adopting new technology – it’s about recognising and embracing that change is a good thing and can bring you real business benefits. Welcoming this mindset will inevitably help your practice to keep pace and prosper.