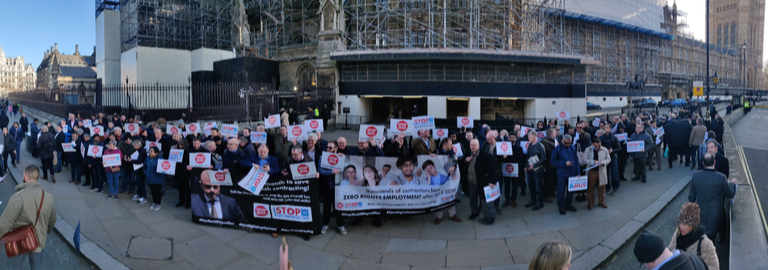

IR35 protestors demand off-payroll tax review

Ahead of 6 April, protestors rallied outside Parliament buildings and called on Sajid Javid for a full legislative review.

Ahead of 6 April, protestors rallied outside Parliament buildings and called on Sajid Javid for a full legislative review.

More than 400 protesters descended on Parliament and HM Treasury yesterday, calling on UK legislators to halt IR35’s progression.

Freelancers and contractors from across the UK expressed their anger over IR35’s private sector changes, chanting for then-Chancellor Sajid Javid to spearhead a full review into the legislation.

“If you look at all of the evidence, and if you decide to make decisions based on the facts, then absolutely, they should abandon these reforms,” said Dave Chaplin, director of the protest.

“It’s been shown that it’s not going to work already, before it’s even come into statute.”

Chaplin said although there are still eight weeks until it comes into force, much of IR35’s damage has been done.

“We were in the same situation before the public sector reforms came in, all the same warnings were given, yet they ignored them—and then they had the carnage on the public side, and they continue to deny that they’ve had problems.”

The regulation is set to become law on 6 April, affecting the amount of income tax and National Insurance that off-payroll employees—like contractors and freelancers—will owe HMRC.

While the government launched a review into IR35 in the private sector in early January, protestors at the event argued there is not enough time for HMRC to make any meaningful change.

Protest attendee Dr Iain Campbell, Secretary General and Deputy Head of Legal at the Independent Health Professionals Association, has already seen the impact of IR35 within the public sector, and worries about the consequences it will have on the private sector.

“Essentially, this is extremely poorly thought out,” Campbell said. “It is so badly thought out as to predispose non-compliance with the legislation, because the admin burden it creates for (medical) trusts—where you have people that don’t know what is a very technical and complicated piece of obscure case law – are then required to make detailed assessments. They can’t do that.

“It is morally wrong to make someone an employee for tax purposes only and deny them all rights—to lumber with them the downsides of both employment and self-employment, and the advantages of neither.”

HMRC’s internal manual on IR35 compliance has been updated several times in both January and February, bolstering the framework of its Check Employment Status for Tax (CEST) tool.

Currently, the responsibility for determining if an employee is within IR35’s remit falls on the limited company being contracted. However, HMRC has updated its rules to only apply to service-based payments on or after 6 April, 2020.

Despite a full IR35 review receiving support from several MPs, including Tim Farron and Sarah Olney, HMRC’s official position on the legislation has not publicly shifted.

When asked about the protest, an HMRC spokesperson said in an email statement: “We have put various measures in place to make sure that contractors and businesses know what is happening, what they need to do, and have dedicated teams providing education and support.

“The change to the long-standing off-payroll rules ensures the correct tax and National Insurance contributions is paid by shifting responsibility for employment status decisions from workers to the organisations they work for.

“The change does not affect people who are self-employed under existing employment status tests and will ensure that tax that was always due is paid. Contractors who are complying with the existing rules will feel little impact.”

On the morning of the protest, accountancy firm inniAccounts published research suggesting that ahead of 6 April, more than 50% of UK contractors and consultants will walk away from their current clients, with only 10% expecting to take on a permanent role.

The research also predicts a £2.2bn economic hit from lost productivity as the workforce leaves ongoing projects.

While Chaplin conceded the protest may not lead to the retraction of IR35, it could stir the government into providing further direction.

“There’s what they should do and what they might do,” he said. “They’re not really known for doing U-turns, so the best hope they have to essentially stem what is a political crisis for the Conservatives is to try to soften the blow—and to do that, they’re going to have to be more honest with their guidance.”

HMRC’s internal manual is available online, but the National Audit Office has confirmed that the CEST tool does not always provide accurate results. However, HMRC has said it will stand by the CEST result.

The government’s review into IR35 is due to be published by 11 March.

Photo credit: Samantha Crowe