Top 10 AI accounting tools every business needs in 2025

In 2025, artificial intelligence (AI) has moved beyond being a buzzword in accounting—it’s now a fundamental part of how businesses manage their finances. The global market for AI in accounting is projected to hit £5.21 billion this year, with forecasts pointing to significant growth, reaching £29.33 billion by 2030.[i]

In the UK, AI is reshaping the accounting landscape, adding over £2 billion to GDP and enabling firms to outpace competitors, growing revenues three times faster than those lagging behind. A growing majority—61% of accountants—see AI as an opportunity to advance their work, using it to reduce mundane tasks, enhance accuracy, and deliver sharper financial insights.

From automating data entry to detecting anomalies and providing predictive analytics, AI has become the accountant’s most trusted partner. As the profession evolves to adapt to client demands and regulatory shifts, the right AI tools can make all the difference.

This guide explores the top 10 AI tools today that are transforming accounting practices, streamlining operations, and empowering professionals to focus on what truly matters—strategic advice and business growth.

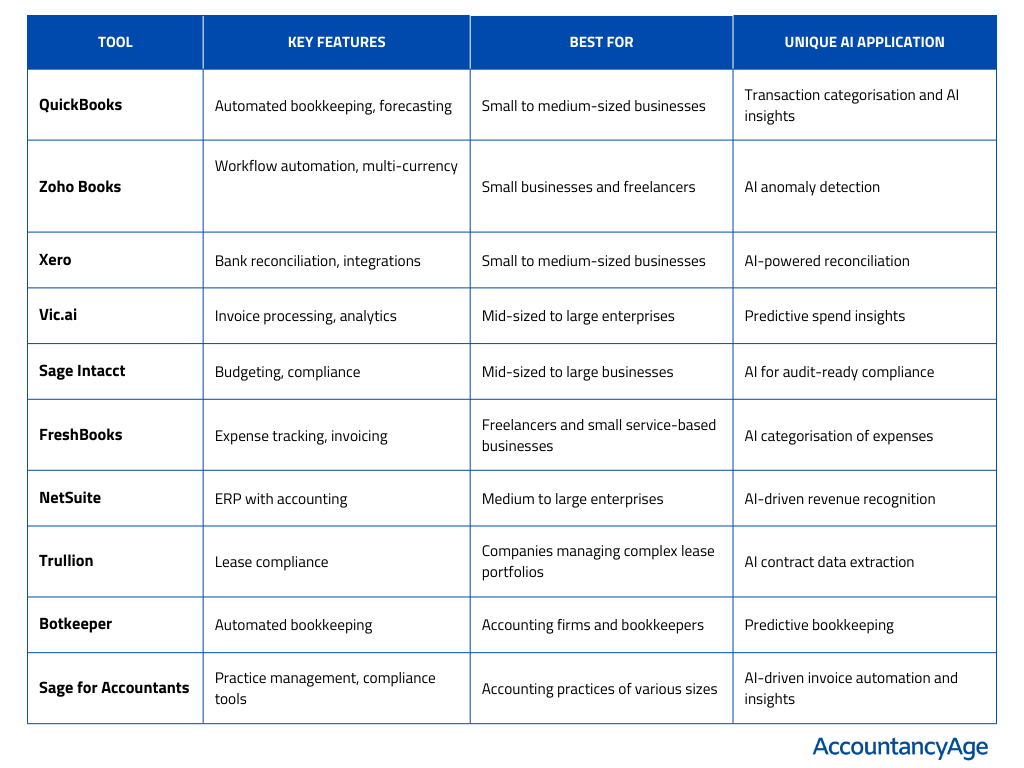

Overview: QuickBooks, developed by Intuit, is a cloud-based accounting solution tailored for small to midsize businesses. It offers a comprehensive suite of financial tools designed to streamline accounting processes.

Key Features:

Best For: Small to medium-sized enterprises (SMEs) seeking a reliable, scalable accounting platform with robust automation capabilities.

Unique AI Application: QuickBooks Online incorporates AI through features like Intuit Assist, an AI-powered assistant that helps users manage invoices, categorise transactions, and gain insights into their financial data.

Overview: Zoho Books is a cloud-based accounting software tailored for small businesses and freelancers. It offers a comprehensive suite of tools to manage finances, including invoicing, expense tracking, and inventory management. Zoho Books is part of the Zoho suite, allowing seamless integration with other Zoho applications.

Key Features:

Best For: Small businesses and freelancers seeking an affordable, user-friendly accounting solution with robust features.

Unique AI Application: Zoho Books employs AI to automate transaction categorisation and detect anomalies, enhancing the accuracy of financial data.

Overview: Xero is a cloud-based accounting platform designed for small to medium-sized businesses. It provides a range of features, including invoicing, bank reconciliation, and financial reporting, all accessible through a user-friendly interface.

Key Features:

Best For: Small to medium-sized businesses looking for a comprehensive accounting solution with strong integration capabilities.

Unique AI Application: Xero utilises AI to streamline bank reconciliation processes, automatically matching transactions to invoices and bills, thereby reducing manual effort.

Overview: Vic.ai is an AI-powered platform focused on automating accounting and financial processes, particularly in accounts payable. It aims to improve efficiency and accuracy by reducing manual data entry and providing real-time insights.

Key Features:

Best For: Mid-sized to large enterprises seeking to automate their accounts payable processes and gain actionable financial insights.

Unique AI Application: Vic.ai leverages machine learning algorithms to process and categorise invoices, eliminating manual data entry and providing predictive insights into spending patterns.

Overview: Sage Intacct is a cloud-based financial management solution designed for growing businesses with complex financial needs. It offers robust accounting capabilities, including core financials and advanced functionalities like multi-entity consolidation.

Key Features:

Best For: Mid-sized to large businesses requiring a scalable financial management system with advanced reporting and consolidation capabilities.

Unique AI Application: Sage Intacct incorporates AI to automate routine accounting tasks and provide real-time actionable insights, enhancing decision-making processes.

Overview: FreshBooks is an accounting software designed for small businesses and self-employed professionals. It focuses on simplifying invoicing, expense tracking, and time management, making it ideal for service-based industries.

Key Features:

Best For: Freelancers and small business owners who need an easy-to-use accounting solution with strong invoicing and time-tracking capabilities.

Unique AI Application: FreshBooks utilises AI to automate expense categorisation and provide insights into business spending patterns, helping users manage their finances more effectively.

Overview: NetSuite Accounting is a leading cloud-based ERP solution offering a full suite of financial management tools. Designed for scalability, it supports businesses of all sizes, providing seamless integration across accounting, CRM, and inventory management.

Key Features:

Best For: Medium to large enterprises requiring a unified system to handle complex financial processes across multiple departments and geographies.

Unique AI Application: NetSuite employs AI-driven anomaly detection and predictive analytics to identify discrepancies in financial data, helping businesses avoid costly errors and optimise decision-making.

Overview: Trullion is a specialised AI-powered accounting platform that focuses on lease accounting, revenue recognition, and financial compliance. It simplifies complex standards like IFRS and US GAAP through automation.

Key Features:

Best For: Companies managing high volumes of contracts and leases, needing automated compliance with accounting standards.

Unique AI Application: Trullion’s AI automatically scans contracts to extract key financial data, reducing manual input and ensuring compliance with accounting standards.

Overview: Botkeeper offers a hybrid bookkeeping solution combining AI and human expertise. It’s tailored for accounting firms looking to scale efficiently while maintaining accuracy in financial records.

Key Features:

Best For: Accounting firms managing multiple clients, looking to reduce manual workloads while improving data accuracy.

Unique AI Application: Botkeeper’s AI algorithms continuously learn and improve over time, enabling it to provide more accurate predictions and suggestions for financial processes.

Overview: Sage offers a suite of accounting solutions tailored to meet the evolving needs of accountants and their clients. Designed for small to medium-sized practices, Sage’s tools focus on automation, compliance, and collaboration. By leveraging cutting-edge technology, including AI-powered features, Sage simplifies everyday tasks and empowers accountants to provide value-added services to their clients.

Key Features:

Best For: Accountants and accounting firms looking to modernise their operations, improve client collaboration, and ensure compliance with tax regulations such as MTD.

Unique AI Application: Sage integrates AI-powered tools like Sage Copilot to automate routine tasks, detect anomalies, and provide actionable insights. This includes features like invoice automation, AI-driven reconciliation, and predictive cash flow analysis, helping accountants focus on advisory services rather than manual data entry.

When selecting an AI accounting tool, businesses should weigh several factors to ensure the best fit for their needs. Consider your budget, specific accounting requirements, and the level of automation you need. Look for tools that integrate seamlessly with your existing systems, provide robust data security measures, and offer reliable customer support. Scalability is also crucial—ensure the solution can grow with your business.

Take time to evaluate multiple options, read reviews, and, if possible, leverage free trials or demos. Hands-on experience with the tool is invaluable in determining whether it aligns with your operational and financial goals.

[i] Conversion is based on a rough exchange rate of 1 USD = 0.78 GBP; actual rates may vary.